Oncology NEWS International

- Oncology NEWS International Vol 17 No 12

- Volume 17

- Issue 12

Phone-time vs face-time: CMS covers limited non-drug services

The ever-growing complexity of chemotherapy coding is so onerous that office managers sometimes lose track of their non-drug billing items. Here are four questions that oft en pop up about nondrug billing and coding.

ABSTRACT: In today’s tight fiscal environment, every dollar-capture counts and every billing error adds to administrative costs.

The ever-growing complexity of chemotherapy coding is so onerous that office managers sometimes lose track of their non-drug billing items. Here are four questions that oft en pop up about nondrug billing and coding.

Q: I can’t get a needy patient off the phone. Can I bill for phone time?

A: Medicare and Medicaid do not make separate payments for services rendered through telephone calls except under Care Plan Oversight Services.

“Physician work resulting from telephone calls is considered to be an integral part of the pre-work and post-work of other physician services, and the fee schedule amount for the latter services already includes payment for the telephone calls,” according to ASCO Practical Tips for the Oncology Practice. As far as E&M services, Medicare and Medicaid pay only for face-to-face contact.

Q: I’m part of a six-doctor community practice. What is Medicare’s criterion for electronic billing for a small practice?

A: All Medicare claims must be filed electronically, although there are exceptions. Small practices are defi ned as entities with fewer than 10 full-time equivalent employees and receive exempt status. But this electronic filing requirement applies only to the initial claim. Subsequent changes, adjustments, or appeals do not have to be filed electronically.

Q: How do I know if lab tests are being properly documented at my practice?

A: First off , lab services are billed with Current Procedural Terminology (CPT) codes: 80048-89240. Every test billed to Medicare must be medically necessary for the patient involved even if the test was part of an automated panel.

To avoid Medicare challenges, the patient’s medical records should individually list all of the medically necessary blood chemistry tests and/or any of the CPT panels (80048-80076).

If you don’t list individual tests or panels, it doesn’t mean you won’t be reimbursed, but it may prompt a Medicare query, especially when numerous tests are ordered.

Q: What about reimbursement for the cost of disposable supplies? For instance, is saline considered a drug or supply?

A: In general, Medicare does not make a separate payment for disposable supplies used in a physician’s office.

Medicare contends that it pays at a level for each service that covers the component costs of supplies.

Saline is eligible for Medicare payment when infused into a patient and should be billed using the appropriate J-code. However, Medicare coverage varies on separate payment for saline that is not infused, but is instead used as a port flush or to mix drugs. So it’s important to check with your local carrier to verify what is considered a supply.

Articles in this issue

about 17 years ago

Radiology resident compiles staging databaseabout 17 years ago

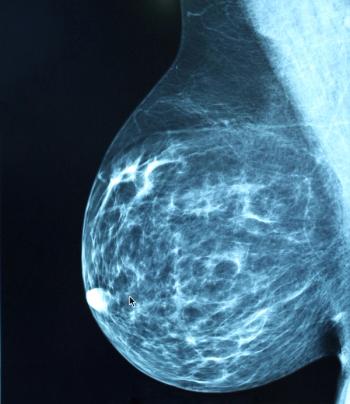

Study links the risk of ALCL to silicone breast implantsabout 17 years ago

Clara Bloomfield: Buck conventional wisdom alwaysabout 17 years ago

New breast cancer program reduces time to treatmentabout 17 years ago

PET/CT for prostate ca influences staging, treatment strategyabout 17 years ago

Racially-based disparities in ca on the rise, not due to smokingabout 17 years ago

ProStrakan offers patch to prevent nausea and vomitingabout 17 years ago

Online tool encourages families to bone up on geneticsabout 17 years ago

Bevacizumab plus copper radiotracer shines as imaging probeNewsletter

Stay up to date on recent advances in the multidisciplinary approach to cancer.