|Slideshows|May 8, 2015

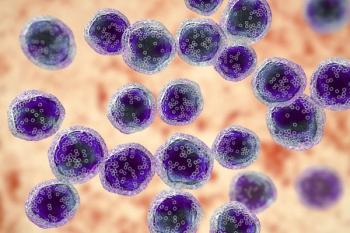

Patient Access to New Cancer Treatments

This slide show looks at patient access to oncology agents both in the United States and abroad, and examines barriers and other constraints preventing new treatments from getting into the hands of patients.

Advertisement

Slides republished with permission from the IMS Institute for Healthcare Informatics. Visit theimsinstitute.org to view the full report, “Developments in Cancer Treatments, Market Dynamics, Patient Access and Value.”

Newsletter

Stay up to date on recent advances in the multidisciplinary approach to cancer.

Advertisement

Latest CME

Advertisement

Advertisement

Trending on CancerNetwork

1

Modifiable Risk Factors Suggest Potential for Improving Cancer Prevention

2

Dato-DXd Receives Priority Review in Unresectable/Metastatic TNBC

3

2026 Tandem Meetings: What’s the Latest Research in Multiple Myeloma?

4

Outlining Advances in AI For Breast Cancer Screening/Radiomics

5