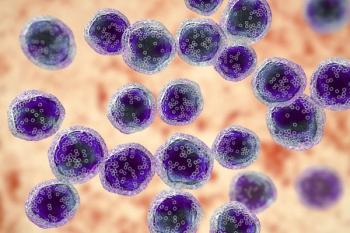

Insurance Status Influences Chronic Myeloid Leukemia Survival Outcomes

Insurance status at the time of chronic myeloid leukemia diagnosis appears to have an influence on survival outcomes, with the uninsured and those on Medicaid having worse overall survival.

Insurance status at the time of chronic myeloid leukemia (CML) diagnosis appears to have an influence on survival outcomes, according to a new study. Those who are uninsured or have Medicaid had significantly worse overall survival than those with Medicare or private insurance.

Tyrosine kinase inhibitors (TKIs) have ushered in an era of extremely effective CML therapy. “These significant advances are contingent upon access and adherence to effective and prolonged TKI therapy, taken once or twice daily, for an indefinite period of time,” wrote study authors led by Andrew M. Brunner, MD, of Massachusetts General Hospital in Boston. “Each of the approved frontline TKIs costs approximately $100,000 per year, a price that may limit access to these highly effective therapies.”

The researchers used the Surveillance, Epidemiology, and End Results (SEER) database to analyze whether insurance status might affect outcomes in CML patients. They included 5,784 patients aged 15 years or older, diagnosed with CML between 2007 and 2012; among those, 337 were uninsured, 785 had Medicaid, and 4,662 had either private insurance or Medicare. Among those were 3,626 patients aged 15 to 64 years at the time of diagnosis, 8.9% of whom were uninsured. The results of the analysis were

Over a median follow-up of 32 months, being uninsured or having Medicaid was associated with worse overall survival compared with insured patients (P < .001) among the non-Medicare population (ages 15 to 64 years). The 5-year overall survival rate was 86.6% in those with insurance, compared with 72.7% in uninsured patients and 73.1% of Medicaid patients. In those aged 65 years or older, the 5-year overall survival rate was no different between Medicaid and other forms of insurance.

An adjusted analysis confirmed that increased risk. For the non-Medicare patients, being uninsured or having Medicaid at the time of diagnosis yielded a hazard ratio (HR) for mortality of 1.93 (95% CI, 1.40–2.66; P < .001) For Medicaid, the HR was 1.83 (95% CI, 1.39–2.40; P < .001). Other factors significantly associated with mortality included older age, male gender, and a marital status of single.

“The example of chronic-phase CML is the paragon for highly effective targeted cancer treatment, yet our findings suggest that such favorable outcomes may not be optimally realized in certain patient populations, in part because of their insurance coverage,” the authors wrote. “This is particularly notable because it is younger patients for whom the impact appears to be greatest.” They suggest that resources to ensure access to treatments may be needed in this and other treatable cancers.

Newsletter

Stay up to date on recent advances in the multidisciplinary approach to cancer.