- ONCOLOGY Vol 12 No 12

- Volume 12

- Issue 12

Response to Increases in Cigarette Prices by Race/Ethnicity, Income, and Age Groups in the United States, From 1976 to 1993

Tobacco use, particularly cigarette smoking, remains the leading cause of preventable illness and death in the United States. Studies have shown that increases in the price of cigarettes will decrease the prevalence of smoking and the number of

Tobacco use, particularly cigarette smoking, remains the leading cause of preventable illness and death in the United States. Studies have shown that increases in the price of cigarettes will decrease the prevalence of smoking and the number of cigarettes smoked by both youth and adults. However, the potential impact of price increases on minority and lower-income populations is an important consideration. This report summarizes the analysis of data for 14 years from the National Health Interview Survey (NHIS), which indicates that lower-income, minority, and younger populations would be more likely to reduce or quit smoking in response to a price increase in cigarettes.

Data from the NHIS from 1976 to 1980, 1983, 1985, and 1987 to 1993 were pooled to conduct the analysis. The NHIS was administered to a nationally representative multistage probability sample of the noninstitutionalized civilian population age ³ 18 years. Smoking histories were obtained for these years in supplements to the NHIS; the overall response rate for these supplements was approximately 80%. Before 1992, participants were asked, Have you smoked at least 100 cigarettes in your entire life? and Do you smoke cigarettes now? In 1992 and 1993, participants were asked, Do you now smoke cigarettes every day, some days, or not at all? Current smokers were persons who reported having smoked ³ 100 cigarettes during their lifetimes and who currently smoked cigarettes. Current smokers were asked, On average, how many cigarettes do you smoke per day? Information on race/ethnicity, income, age, and other demographic factors were obtained from the core of the NHIS questionnaire.

Using data reported by the Tobacco Institute, the average price of a pack of cigarettes for each state, adjusted for inflation, was merged into the NHIS data by year and state of residence. The 14 cross-sections of the NHIS have 367,106 respondents; of these, 355,246 respondents had complete demographic and price data (~24,000 respondents per year).

Two types of multiple regression models were estimated. A probit (limited dependent variable) model was used with the full sample (N = 355,246) to estimate the change in the probability of smoking (1 for current smokers and 0 for all other respondents) for a change in the inflation-adjusted price (1982 to 1984 dollars). An ordinary least squares model, restricted to current smokers (N = 112,657) with self-reported number of cigarettes smoked per day as the dependent variable, was used to estimate the relation between inflation-adjusted price and quantity of cigarettes consumed.

Both models controlled for year, region of the country (Northeast, South, Midwest, and West),a age, sex, race/ethnicity, education, marital status, family income, and urbanicity (based on residence in a metropolitan statistical area [MSA] central city, MSA city, or rural area). Separate subpopulation models were estimated by race/ethnicity (Hispanics, non-Hispanic blacks, and non-Hispanic whites), by age group (ages 18 to 24, 25 to 39, and ³ 40 years), and by income group. Self-reported family incomes from all survey years were inflation-adjusted to 1982 to 1984 dollars, and the sample median was computed for all respondents reporting family income data. Respondents with incomes equal to or below the median were compared with those above the median income ($33,106 in 1997 dollars). All subpopulation models included the control variables used in the full models.

For all models, the effect of price is expressed as price elasticities. Price elasticity is a standardized measure indicating the percentage change in the dependent variable (ie, smoking prevalence or number of cigarettes consumed per day) for a 1% change in the inflation-adjusted price of cigarettes (independent variable). Prevalence price elasticity, using price coefficients from the probit regression models, is the percentage reduction in the prevalence of smoking that would be predicted from a 1% price increase. Consumption price elasticity, using price coefficients from the linear regression models, is the percentage reduction in the average number of cigarettes smoked by persons who continue to smoke after a 1% price increase. Total price elasticity is the sum of smoking prevalence and cigarette consumption price elasticities.

Results

For all respondents, the models estimated a prevalence price elasticity of 0.15 and a consumption price elasticity of 0.10, yielding a total price elasticity estimate of 0.25. Therefore, a 50% price increase could cause a 12.5% reduction in the total US cigarette consumption (ie, 50% × -0.25 = -12.5%), or approximately 60 billion fewer cigarettes smoked per year. In the age-specific model, younger smokers were more likely than older smokers to quit smoking, and after controlling for income, education, and other nonprice variables, Hispanic smokers and non-Hispanic black smokers were more likely than white smokers to reduce or quit smoking in response to a price increase. This pattern was consistent for all age groups (

Editorial Note From the CDC

The findings in this report indicate that lower-income and minority smokers would be more likely than other smokers to be encouraged to quit in response to a price increase and thus would obtain health benefits attributable to quitting. Other studies also have found that youth, young adults, and lower-income populations are the most price responsive. In this study, smokers with family incomes equal to or below the study sample median were more likely to respond to price increases by quitting than smokers with family incomes above the median (eg, 10% quitting compared with 3% quitting in response to a 50% price increase). After controlling for income and education, Hispanics and non-Hispanic blacks are substantially more price-responsive than other smokers. Data from this model suggest that Hispanic smokers were the most price-responsive. Non-Hispanic black smokers would respond to price increases primarily by quitting rather than reducing the number of cigarettes smoked per day.

This study is subject to at least five potential limitations. First, because the analysis is based on pooled cross-sectional surveys, the estimates of price elasticity could underestimate the long-term response to price changes that would be observed from longitudinal surveys. Second, this analysis does not control fully for other factors unrelated to price (eg, differences between states in social and policy environments) that could reduce demand and be confounded with the states excise tax level. Third, because not all respondents for whom price data were available reported family income, the analysis by income categories could be less representative than other subpopulation analyses. Fourth, the sample sizes in subpopulation analyses by race and age (

Comprehensive measures for promoting cessation and reducing the prevalence of smoking include increasing tobacco excise taxes, enforcing minors access laws, restricting smoking in public places, restricting tobacco advertising and promotion, and conducting counteradvertising campaigns. Because state tax increases are more effective when combined with a comprehensive tobacco prevention and control program, price increases should be combined with such programs to increase their public health impact. Court settlements with several states and other market factors have resulted in the tobacco industry increasing the wholesale price of cigarettes by 12.2% since January 1997. Although this and potential future industry price increases will reduce smoking prevalence and consumption (particularly among adolescents and young adults), most adult smokers will continue to smoke and pay the higher cigarette prices. Tobacco-use prevention and cessation programs should be made available to benefit those populations paying the greatest share of the increased prices. Smoking prevention will always remain a primary public health objective, but public health efforts encouraging cessation particularly are needed for smokers age ³ 40 years, who would be the most likely group to continue smoking and paying the higher cigarette prices. In addition, tobacco-use prevention and cessation programs should be directed toward lower-income and minority populations, in whom the burden of tobacco-related disease is high.

Articles in this issue

about 27 years ago

Monoclonal Antibody Approved for Metastatic Breast Cancerabout 27 years ago

Booklet Provides Guidance on Appointing or Being a Health Care Proxyabout 27 years ago

Lower Genital Tract Neoplasia in Women With HIV Infectionabout 27 years ago

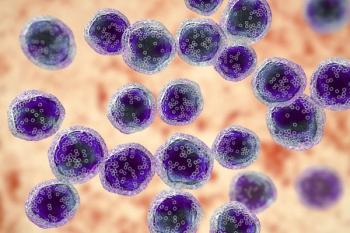

Clinical Status and Optimal Use of Rituximab for B-Cell Lymphomasabout 27 years ago

Clinical Status and Optimal Use of Rituximab for B-Cell LymphomasNewsletter

Stay up to date on recent advances in the multidisciplinary approach to cancer.